Introduction

You would have probably heard of the adage “what you pay is what you get”. While this might be true for many things in life, I often find myself asking whether the exorbitant tuition fees from Columbia and UCL were truly worth it. College is undeniably a huge investment for many because of the immense expenses and time invested. As a result, I wanted to find out whether there is a relationship between the cost of college and the “ROI” / Return on Investment for pursuing higher education (in this case, the starting salary).

Before I begin, I wish to state that there are many benefits from college that cannot be quantified. These might include finding a dream job, building personal networks or having the opportunity to forge a defining life experience. The analysis in this post is inherently limited and arguably superficial since I will only be looking at how tuition relate to starting pay. I also believe that it is not necessary to obtain a degree in order to be happy or successful. There are many other attributes and qualities that are more important and valuable than academic qualifications. Furthermore, we are living in an amazing time where there is a plethora of alternatives to college, such as online courses, self-learning or on-the-job training and apprenticeships.

The Dataset

In this post, I am excited to analyze and visualize the US College Tuition, Diversity and Pay dataset from #TidyTuesday. If you are interested in exploring the data yourself, click here. The tuition and room and board fees were obtained from the Chronicle of Higher Education (2018-2019), while the starting salary data comes from payscale.com. There are about 728 schools in the merged dataset with information regarding salary potential and tuition costs.

Cost of College

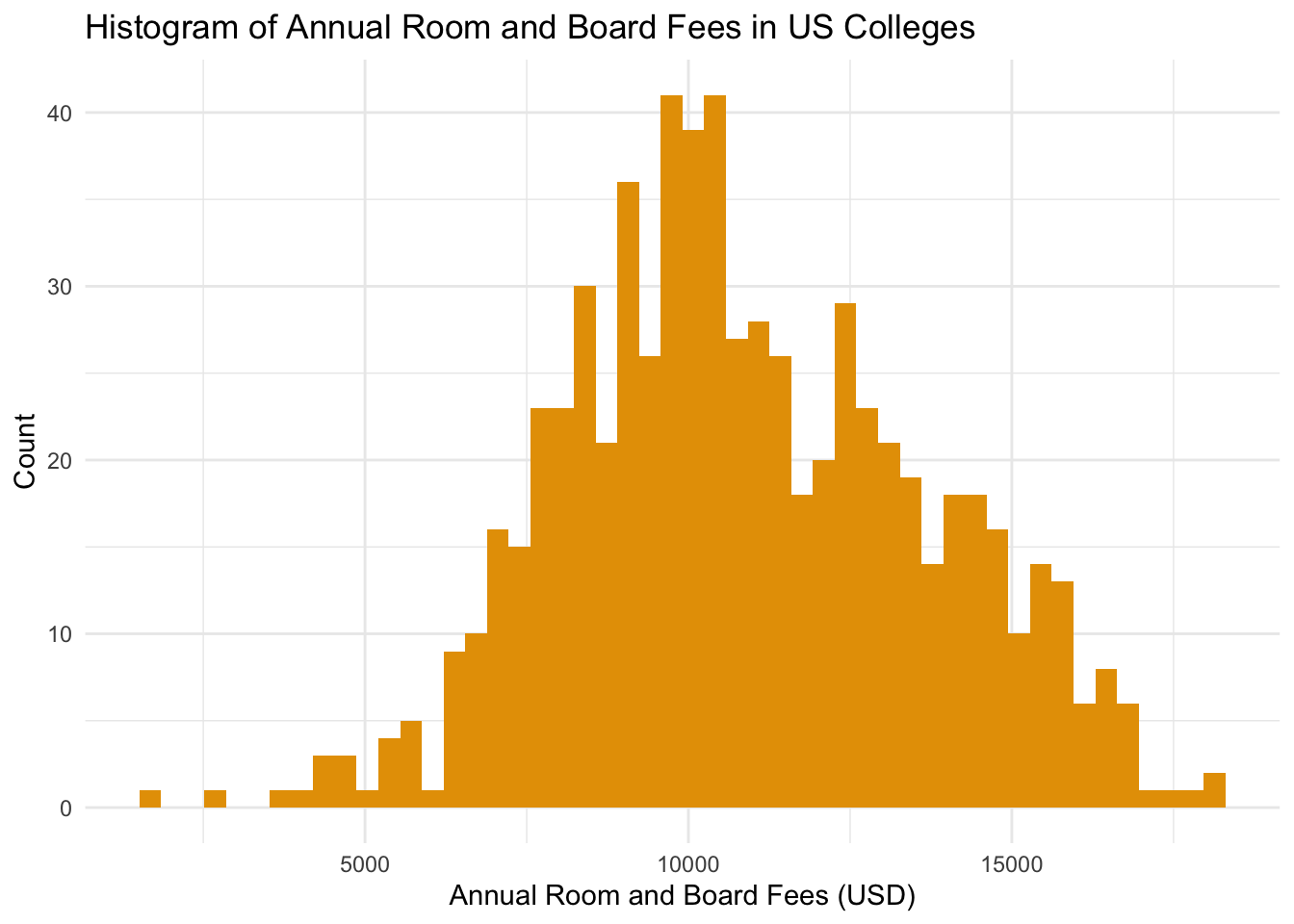

I thought that an interesting place to start would be to investigate the annual cost of college across the US, which is mainly made up of tuition and room_and_board. The average annual cost of room and board across colleges in the US is 10.8k USD and the median is 10.5k USD.

Additionally, annual college tuition fees can vary for students based on whether they are in-state or out-of-state. The system of in-state or out-of-state applies predominantly to public colleges. Additionally, the cost of college can differ based on their categories, e.g. public, private or for profit.

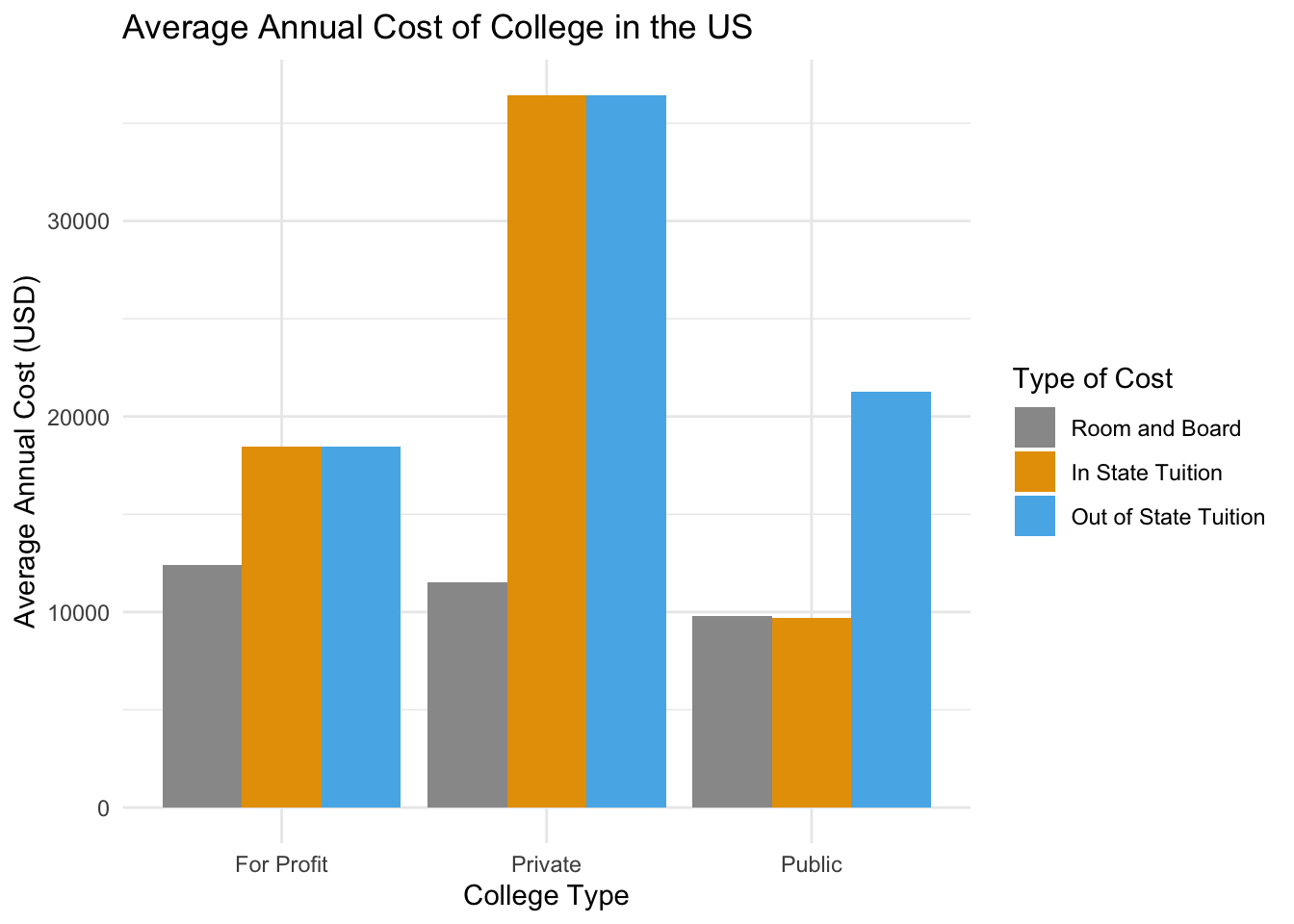

From the chart below, we can tell that:

- the average annual cost of room and board is quite similar across the different types of colleges

- annual tuition fees vary across types of college

- private colleges are the most expensive

Generally, for profit colleges have the highest annual room and board (12.4k USD) followed by private colleges (11.5k USD) and then public colleges (9.7k USD). Tuition fees can jump by 3 folds between a public and a private college. The average annual in-state tuition is 9.7k USD whilst the average annual private in-state tuition is 36.3k USD, the average annual for profit in-state tuition is 18.5k USD. The difference between average annual out-of-state tuition is less stark between private and public colleges at 36.4k USD and 21.2k USD (respectively). It is also interesting to note that there is no difference between in state or out-of-state tuition for private and for profit colleges, suggesting that this characteristic is unique to public US colleges.

Annual Cost of College by State

Across the US, the cost of college also differs quite significantly. From the map below, I have plotted the average out-of-state tuition fees plus the room and board. It is not surprising to see that the most expensive colleges tend to be in New York, Pennsylvania, Massachusetts and California. These states generally also have the highest costs of living across the country.

Return on Investment?

Going back to the main question, I wanted to find out if there is a relationship between the annual cost of college and starting salary of college students after graduation as that seems like a measurable return on investment for most students. I built a scatter plot of the 2 variables - total out-of-state college fees and starting pay to see how they would relate to each other.

From the scatter plot, we can see that:

- There are a number of colleges that have high starting pay (well over the mean and median values) but were not as well-known as the Ivy league colleges or top ranking universities that we normally hear about

- I also noticed a positive relationship between starting pay and total college fees, suggesting that the higher the total college fees, the higher the starting pay

I believe that colleges like Charles R Drew University of Medicine and Science, Albany College of Pharmacy and Health Sciences, Harvey Mudd College and Webb Institute offer a great quality of education and result in higher average starting pay for their students. However, they are less well-known because they might take in fewer students, cater to a more local demographic and are younger institutions.

From the scatter plot it does seem like “what you pay is what you get”.

In order to better analyze this, I computed a linear regression of the 2 variables and found that there is a positive correlation coefficient close to 0.32 with a p-value that is < 0.05, suggesting that there is indeed a positive relationship between the 2 variables. Additionally, the low p-value suggests that the model is statistically significant.

##

## ===============================================

## Dependent variable:

## ---------------------------

## early_career_pay

## -----------------------------------------------

## out_of_state_total 0.316***

## (0.016)

##

## Constant 38,035.660***

## (687.492)

##

## -----------------------------------------------

## Observations 728

## R2 0.359

## Adjusted R2 0.358

## Residual Std. Error 6,624.182 (df = 726)

## F Statistic 406.199*** (df = 1; 726)

## ===============================================

## Note: *p<0.1; **p<0.05; ***p<0.01Nevertheless, the adjusted R-squared of the model is only 0.36, which means that the model only explains 36% of the variance in the data. From the scatter plot above, there appears to be a curvature or non-linear pattern that might not be well-explained by a linear regression model. Therefore, I tried to use a quadratic regression model instead and managed to get a better adjusted R-squared of 0.41. The quadratic model explains 41% of the variance in the data, an improvement of 5%.

##

## ==================================================

## Dependent variable:

## ---------------------------

## early_career_pay

## --------------------------------------------------

## out_of_state_total -0.300***

## (0.078)

##

## I(out_of_state_total2) 0.00001***

## (0.00000)

##

## Constant 49,482.590***

## (1,563.554)

##

## --------------------------------------------------

## Observations 728

## R2 0.412

## Adjusted R2 0.410

## Residual Std. Error 6,349.488 (df = 725)

## F Statistic 253.641*** (df = 2; 725)

## ==================================================

## Note: *p<0.1; **p<0.05; ***p<0.01When I plot the linear and quadratic regression lines on the scatter plot, we can indeed see that the quadratic model seems to fit the data better than the linear model.

Overall, I do not think that we can assuredly say that the high cost of college is worth it based on this analysis. I am only looking at the average starting salary for the entire college, which is not representative of every student. It is likely that salary differs based on different degrees and academic achievement. This might explain why some medical-schools have high average starting salaries because all their students go on to join the healthcare profession.

Additionally, there would be other costs and benefits, which cannot be factored into this simple and naive model. However, I believe that I can confidently claim that based on this dataset, there is a positive relationship between the total cost of out-of-state college fees and the average starting salary of the college.